lincoln ne sales tax rate 2018

In Nebraska what are the sales and use tax rates. Current Local Sales and Use Tax Rates and Other Sales and Use Tax.

Gross Receipts Location Code And Tax Rate Map Governments

There is no applicable special tax.

. State county and city sales tax rates are included in this equation. Does Nebraska Have Local Sales Tax. The County sales tax rate is.

There are sales tax rates for each state county and city here. 0001516 0001409 0001391 0001347-316 -1115 airport authority 0000000 0000000 0000000 0000000 na na. You can print a 725 sales tax table here.

You can print a 10 sales tax table here. There is no applicable special tax. The 875 sales tax rate in Lincoln consists of 625 Illinois state sales tax 2 Logan County sales tax and 05 Lincoln tax.

Lincoln Ne Sales Tax Rate 2018 Agustus 05 2021 Dapatkan link. For tax rates in other cities see Washington sales taxes by city and county. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit.

The 10 sales tax rate in Lincoln consists of 4 Alabama state sales tax 1 Talladega County sales tax and 5 Lincoln tax. You can print a 8 sales tax table here. Lincoln NE Sales Tax Rate.

Lexington NE Sales Tax Rate. There is no applicable county tax or special tax. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

There is no applicable city tax or special tax. Nebraska Department of Revenue. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

In Lincoln Nebraska all taxes will be equalized by a combined 744 starting in 2021. The additional tax rate will begin in October because of the timelines set by the state and will bring the city sales tax to 175 percent for the next six years. A 0 percent local sales tax and a 0 use tax can also be imposed.

The sales tax jurisdiction name is Lincoln Center which may refer to a local government division. There is no applicable special tax. Did South Dakota v.

800-742-7474 NE and IA. A total of 7 per cent of Lincoln Nebraskas total sales taxes is required in 2021. Nebraska Sales Tax Rate Finder.

The 85 sales tax rate in Lincoln consists of 65 Kansas state sales tax 1 Lincoln County sales tax and 1 Lincoln tax. The 2018 United States Supreme Court decision in South Dakota v. McCook NE Sales Tax.

You can calculate sales taxes for every county city state and federal district in the country. Nebraska is not a part of the federal sales tax. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

There is no applicable special tax. Lincoln Nebraska has a sales tax rate. The December 2020 total local sales tax rate was also 5500.

Lincoln Nebraska must have a combined sales tax rate of at least 7 in 2021. Changes in Local Sales and Use Tax Rates Effective April 1 2019 Nebraska Department of Revenue. There is no applicable special tax.

1 the Village of Orchard will start a 15 local sales and use tax. The 2018 United States Supreme Court decision in South Dakota v. 201415 201718 201819 201920 1 yr 5 yr tax rates for taxpayers rate rate rate rate change change inside lincoln city limits agric.

Local governments can also impose a 2 local option sales tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates. What Is Nebraska Sales Tax Rate.

During 2018 there were 295 local tax jurisdictions in the state that collected a total of 0000 in average local taxes. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. One percent one percent one percent.

The minimum combined 2021 sales tax rate for Lincoln Nebraska is. Has impacted many state nexus laws and sales tax collection requirements. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019.

Society of lancaster co. There is no applicable special tax. Tax rates are provided by Avalara and updated monthly.

Does the sales tax rate look like a sales tax rate in Lincoln Nebraska. Wayfair Inc affect Nebraska. In cities and counties the proportion of labor costs is 75 and 2 respectively.

La Vista NE Sales Tax Rate. For tax rates in other cities see Nebraska sales taxes by city and county. The Nebraska sales tax rate is currently.

The 8 sales tax rate in Lincoln consists of 65 Washington state sales tax and 15 Lincoln County sales tax. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. The Nebraska state sales and use tax rate is 55 055.

The Lincoln sales tax rate is. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. You can print a 875 sales tax table here.

Taxation of the Cornhusker State of Nebraska has a 5 percent sales tax. Nebraskas sales and use taxes are five percent. Look up 2021 sales tax rates for Lincoln Massachusetts and surrounding areas.

Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for. 025 lower than the maximum sales tax in NE.

Corporate Tax In The United States Wikiwand

Why Households Need 300 000 To Live A Middle Class Lifestyle

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

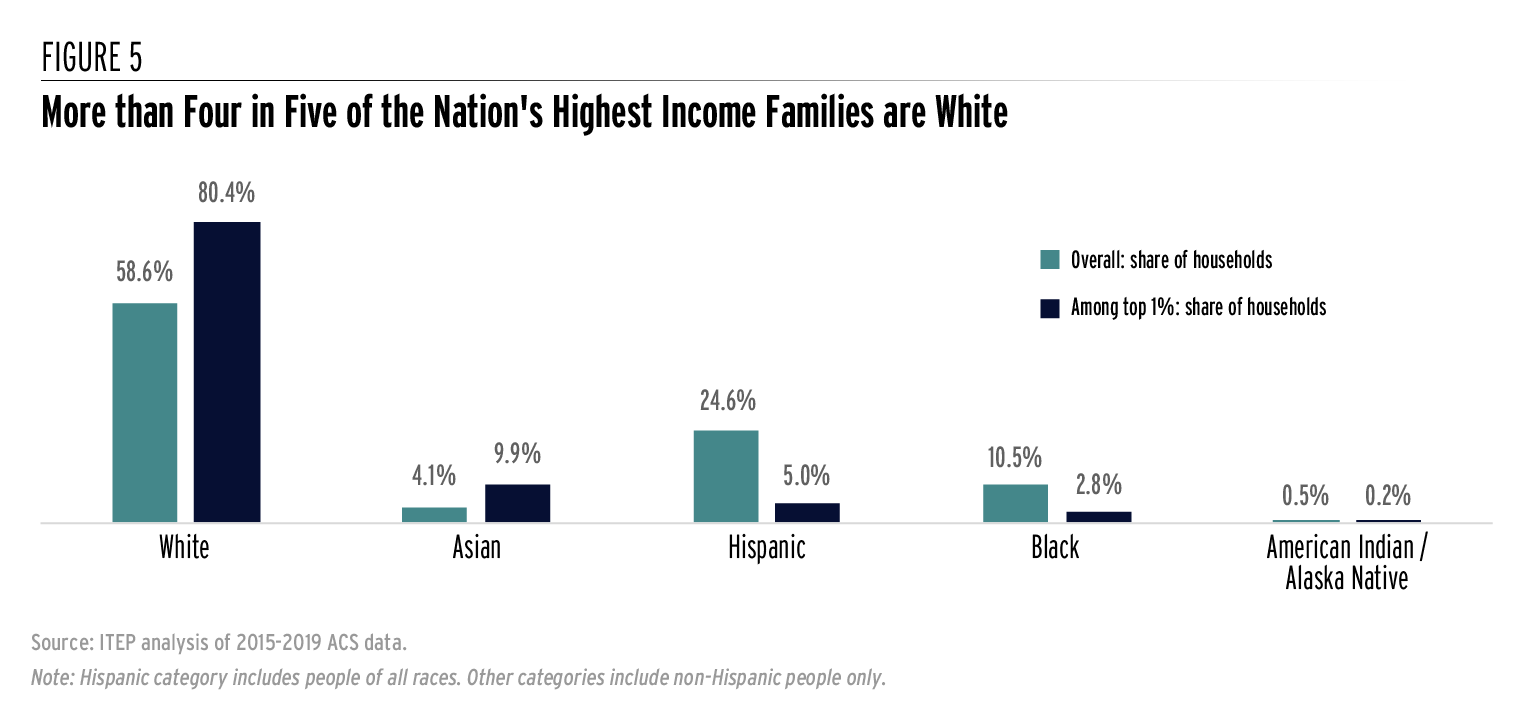

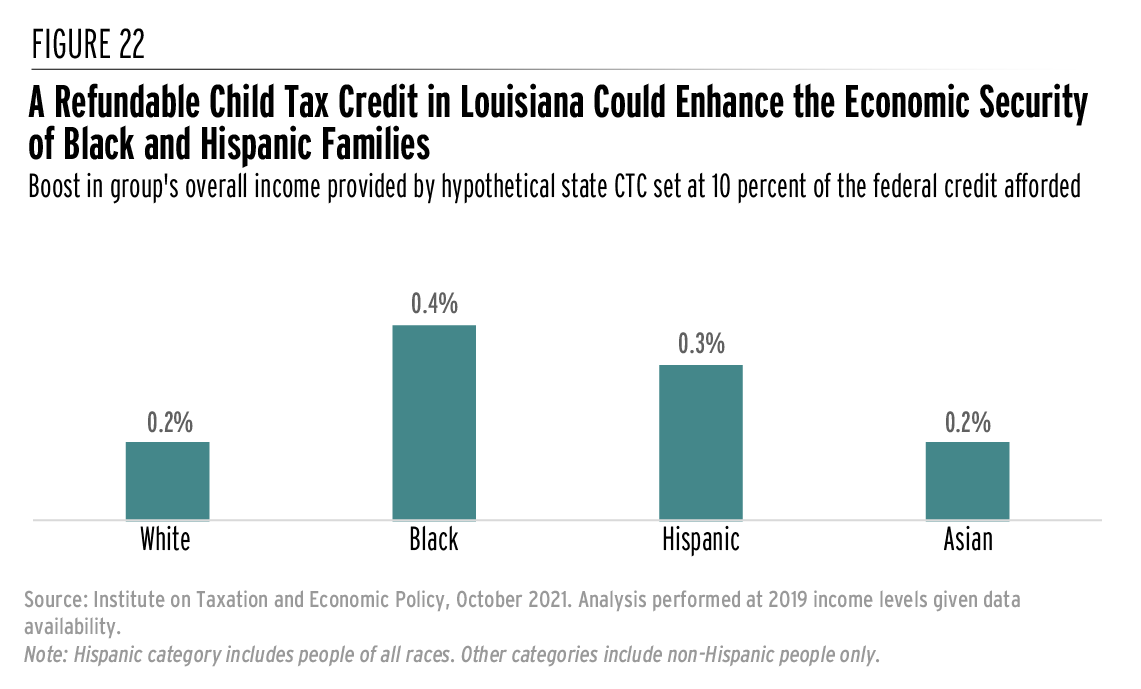

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

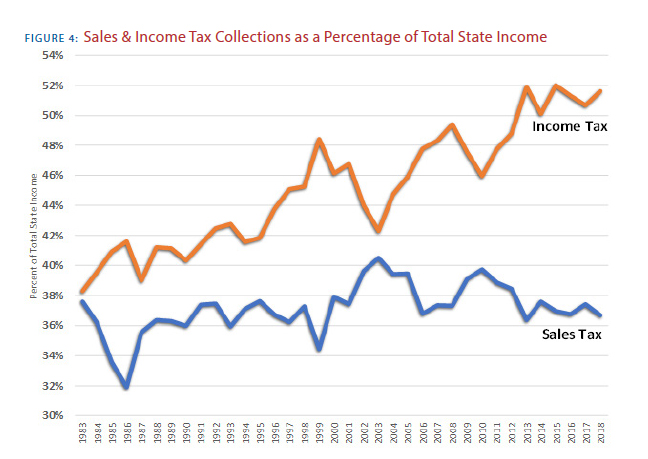

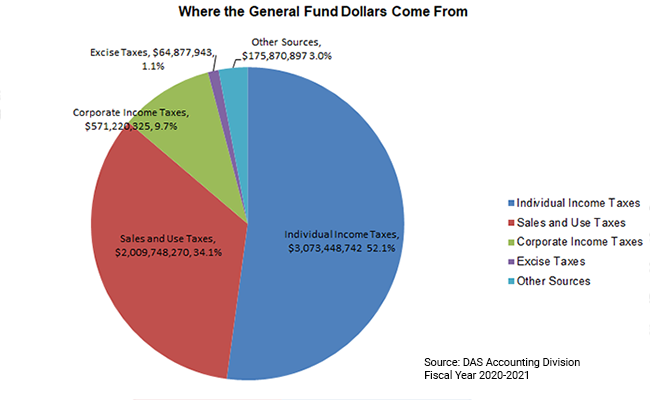

General Fund Receipts Nebraska Department Of Revenue

Corporate Tax In The United States Wikiwand

Why Households Need 300 000 To Live A Middle Class Lifestyle

Corporate Tax In The United States Wikiwand

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep